529 Qualified Expenses: What expenses can a 529 plan cover?

Key Takeaways

Qualified expenses from 529 plans are not taxed at the federal level—provided you understand and follow all the rules for qualifying expenses.

529 savings plans aren't just for college tuition and fees; there are many ways to use your 529 funds for other educational expenses.

You can spend up to $10,000 from a 529 plan on tuition expenses for elementary, middle, or high school.

Starting in 2024, families can rollover unused 529 funds into a Roth IRA account for the beneficiary.

Non-qualified expenses are treated like ordinary income: state and federal taxes will apply, with a 10% federal penalty for withdrawals used to pay for them.

What is a 529 plan?

A 529 plan is a tax-advantaged investment account designed to help families save for education. When used for qualified expenses, withdrawals are tax-free, making it a valuable tool for parents and relatives planning for a child's educational future.

Contributing to a 529 plan not only supports long-term savings goals but also provides significant tax benefits when the funds are used appropriately. However, understanding the plan’s rules—particularly around qualified expenses—is critical. Mistakes can be costly at tax time, and in some cases, may even impact your child's eligibility for financial aid. Learning the ins and outs of 529 plans in advance ensures you can maximize its benefits and avoid potential pitfalls.

How to calculate 529 plan qualified expenses

Qualified expenses are federal income tax-free as long as the total withdrawals for the year don’t exceed your child’s adjusted qualified higher education expenses (QHEEs). If your withdrawals are equal to or less than your QHEEs, the withdrawals—including earnings—are tax-free. However, if withdrawals exceed QHEEs, taxes and potentially a penalty will apply to the earnings portion of the excess.

For most families, keeping records is straightforward since large tuition bills typically consume most 529 savings. However, if you’re using your 529 plan for room and board expenses, it’s smart to keep receipts.

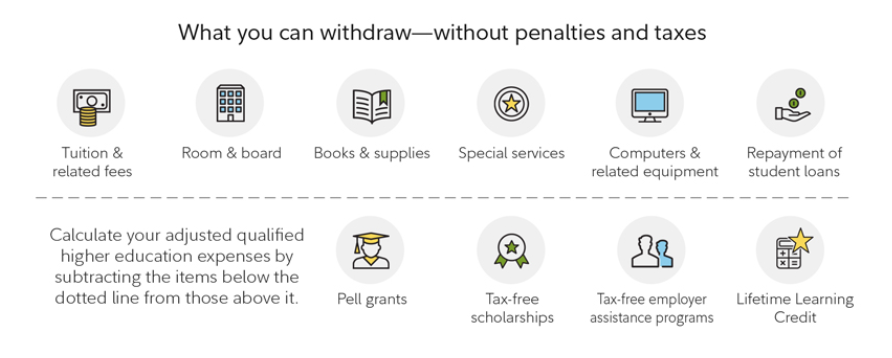

To calculate QHEEs:

Add up expenses for tuition, fees, room and board, books, supplies, school-related special needs, and computer costs.

Subtract any costs already covered by tax-free educational assistance (e.g., Pell grants, scholarships, tuition discounts, or employer educational assistance).

Deduct expenses used to claim the American Opportunity Tax Credit or Lifetime Learning Credit.

What expenses can a 529 plan cover?

Qualified higher education expenses cover costs necessary for enrollment or attendance at a college, university, or other eligible post-secondary institution. For 529 plan purposes, this also includes up to $10,000 per year for K-12 school tuition and up to $10,000 for student loan repayments.

Let’s get into the details and break down each expense:

Tuition and fees

529 plan funds can be used to pay the full amount of tuition and fees for eligible schools, including colleges, universities, vocational or trade schools, and public, private, or parochial elementary and secondary schools. This is not limited to physical classes; online classes may qualify as well. As long as the institution is eligible, you can use 529 plan funds to pay for online tuition and fees.

Additionally, the Tax Cuts and Jobs Act of 2017 allows families to use 529 funds to pay up to $10,000 in tuition at K-12 schools (elementary and secondary). This applies to public, private, and parochial schools.

Books and supplies

Books and supplies include textbooks, lab materials, safety equipment, notebooks, and anything mandatory for coursework. Essentially, anything required for student courses qualifies as a qualified expense.

Keep in mind that you won’t be able to claim books and supplies that aren’t mandatory.

For instance, if you’re enrolled in a graphic design course and the syllabus requires a specific design textbook, purchasing that book qualifies as a 529 plan expense. However, if you buy a general art history book for personal interest, it wouldn't qualify.

Computers, software, and internet access

Computers, software, and internet access are considered qualified expenses, as is peripheral equipment such as mouses, speakers, and software required for college courses. These items must be used by the beneficiary primarily during their enrollment. Any software for entertainment, or electronics like smartphones, are not qualified expenses. If the student purchases such items, they won’t qualify and will be fully taxed.

Room and board

After tuition and fees, room and board are typically the second largest college expense. Funds in a 529 plan can be used for qualified room and board expenses, such as rent, other housing costs, and meal plans. These funds may be used for both on-campus and off-campus housing as long as the student is enrolled at least half-time. The student must also be working toward a degree, certificate, or another recognized credential.

If the student lives off-campus, the withdrawal is limited to the amount the school reports in its cost of attendance. Any amount above that is considered a non-qualified expense.

Rent incurred during the summer months is also a qualified expense if the student is enrolled at least half-time.

Study Abroad

529 plan funds can be used for study abroad programs, subject to the same restrictions as for U.S.-based study. This includes tuition and fees, books and supplies, and room and board. However, certain expenses, such as airfare, travel costs, international health insurance, and personal expenses (like entertainment), are not qualified.

Special needs equipment and services

This includes items or services necessary to support the education of a student with disabilities. These expenses must directly relate to the student’s enrollment or attendance at an eligible institution.

Additionally, families with special needs may want to consider using a 529 ABLE account, which is specifically designed for individuals with disabilities.

Student loans

The SECURE Act of 2019 expanded the definition of qualified expenses to include repayment of the principal and interest on qualified student loans for the beneficiary.

However, the law limits 529 plan withdrawals for student loan repayment to a lifetime maximum of $10,000. This means you cannot make multiple withdrawals from different 529 plans to exceed this limit.

ROTH IRA

Starting in 2024, the SECURE Act 2.0 allows leftover funds in a 529 plan to be transferred to the beneficiary’s Roth IRA. Some rules to note:

The 529 account must have been open for at least 15 years.

The rollover amount must have been in the 529 plan for at least 5 years.

The lifetime limit is $35,000 for each 529 plan beneficiary.

Rollovers can only be made to the Roth IRA of the named beneficiary.

This option provides parents with a way to use unused 529 funds by converting them into a Roth IRA for the beneficiary.

Keep in mind that not all states follow the federal definition of qualified 529 expenses. Be sure to check your state’s guidelines to avoid potential state tax penalties when rolling over funds to a Roth IRA.

What are some non-qualified expenses?

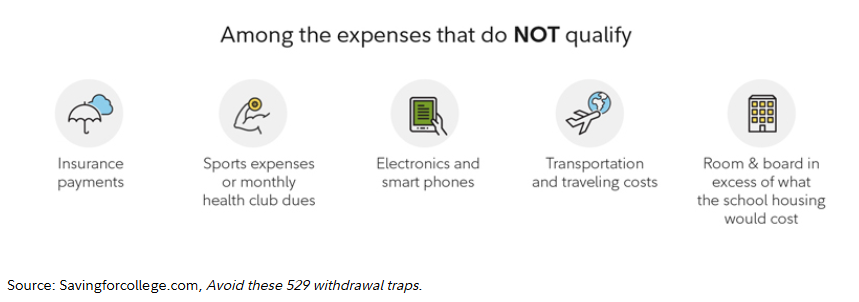

Not everything related to college qualifies as a 529 plan expense. Some examples of non-qualified expenses include:

Transportation and Travel Costs – Costs like gas, transit passes, car rentals, and vehicle maintenance are not qualified expenses. Any withdrawals for these purposes will be considered non-qualified.

Health Insurance – While certain medical expenses like therapy or special needs equipment may qualify under specific circumstances, health insurance is not considered essential for enrollment or attendance. An exception may apply if health insurance is part of a comprehensive tuition fee or required for enrollment.

Application and Testing Fees – Costs incurred before admission, such as college application and testing fees, are not qualified.

Extracurricular Activities, Sports, and Health Club Dues – These are generally not considered qualified expenses.

What happens if you incur non-qualified expenses in your 529?

If you use 529 plan funds for non-qualified expenses, you’ll incur taxes and penalties that reduce the benefits of the plan. The earnings portion of a non-qualified withdrawal is subject to federal income tax, and you may face an additional 10% penalty.

States may also impose penalties. If your state provided a tax deduction or credit for contributions, you may need to repay that benefit. For example, California imposes a 2.5% tax penalty on top of the 10% federal penalty.

Finals thoughts

529 plans play a crucial role in saving for college, but understanding the rules—especially regarding qualified expenses—is essential. As we’ve described, qualified expenses include more than just tuition, and withdrawals can be used tax-free for books, computers, room and board, and more. Using 529 funds effectively can help you maximize your educational savings.

Connect with Us Today

Schedule a free 30-minute consultation call. We’ll learn more about your priorities and ensure we can answer all of your questions.