Here’s How Much Americans are Saving For Retirement

Key Takeaways

In 2023, the average account balance for Vanguard participants was $134,128, while the median balance was $35,286.

The average participant contribution reached a high of 7.4%, and when combined with employer contributions, this figure reached 11.7%.

A record-high 59% of plans offered automatic enrollment, and among these plans, 60% defaulted employees at a deferral rate of 4% or higher.

A report released earlier this year shows that once again, Americans are saving at historic rates in 2023, with a record-high of 401k participants increasing their savings rate. The comprehensive data material in How America Saves, issued by Vanguard, depicts the trends of the retirement behavior of nearly five million Vanguard participants.

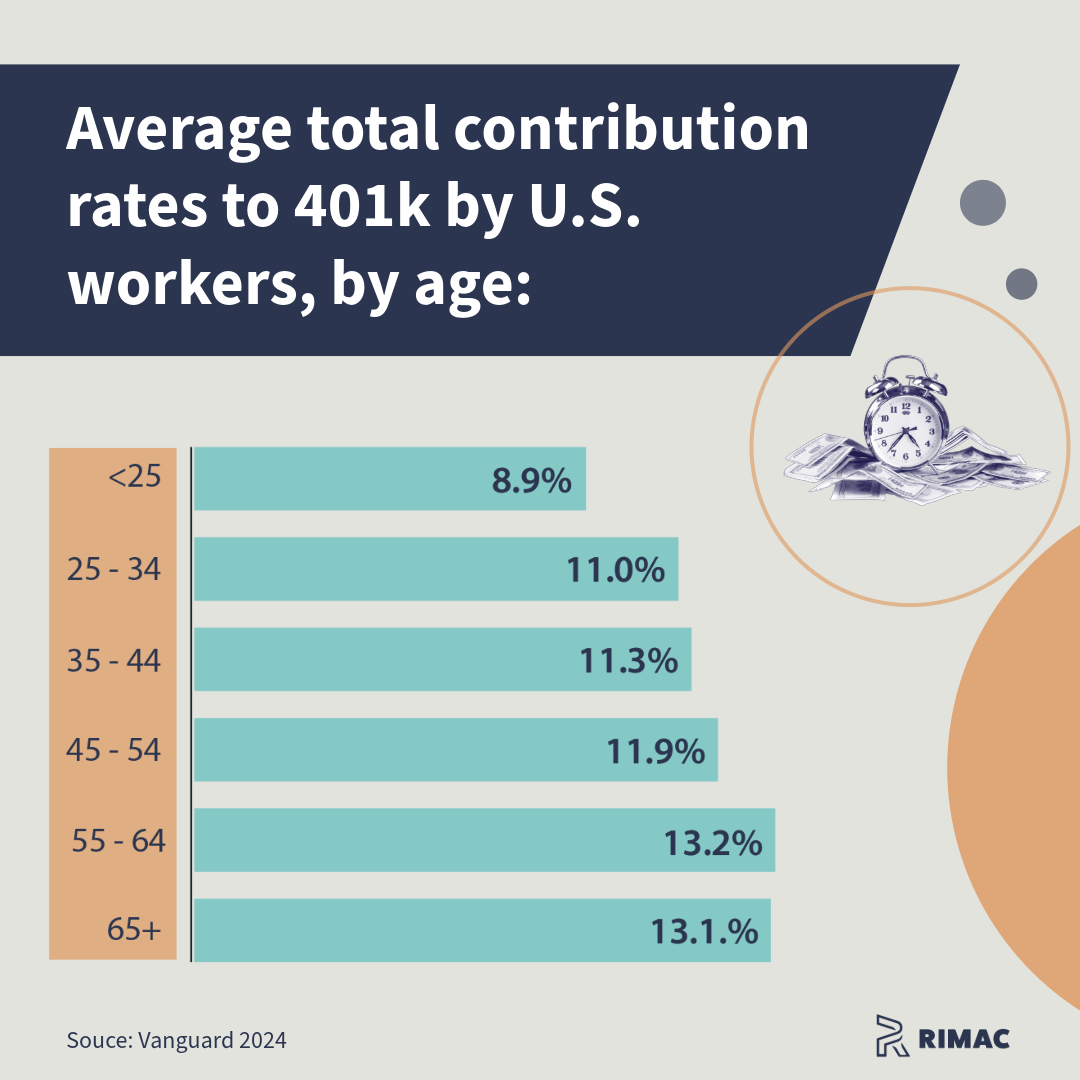

The report found that employees are contributing at record amounts into their 401ks of 7.4% in 2023, and when combined with employer contributions, the average participant total savings rate reached an all-time high of 11.7%. Take a look at the average retirement savings rate for investors at every age taking into account both employer and employee contributions:

Source: Vanguard 2024

According to Vanguard this increase was due to greater adoption of automatic enrollment plans, which has shown to improve participation rates. Historically, employees have had to decide whether to participate in their employer’s plans and at what rate to save; however, now employers are increasingly making these decisions for employees through automatic enrollment. By year-end 2023, 59% of Vanguard plans had adopted automatic enrollment, including 77% of plans with at least 1,000 participants. Among the auto-enrollment plans, 60% defaulted employees at a contribution rate of 4% or higher. This compared dramatically to 2014 when only 35% of plans defaulted employees into the plan at a rate of 4% or higher.

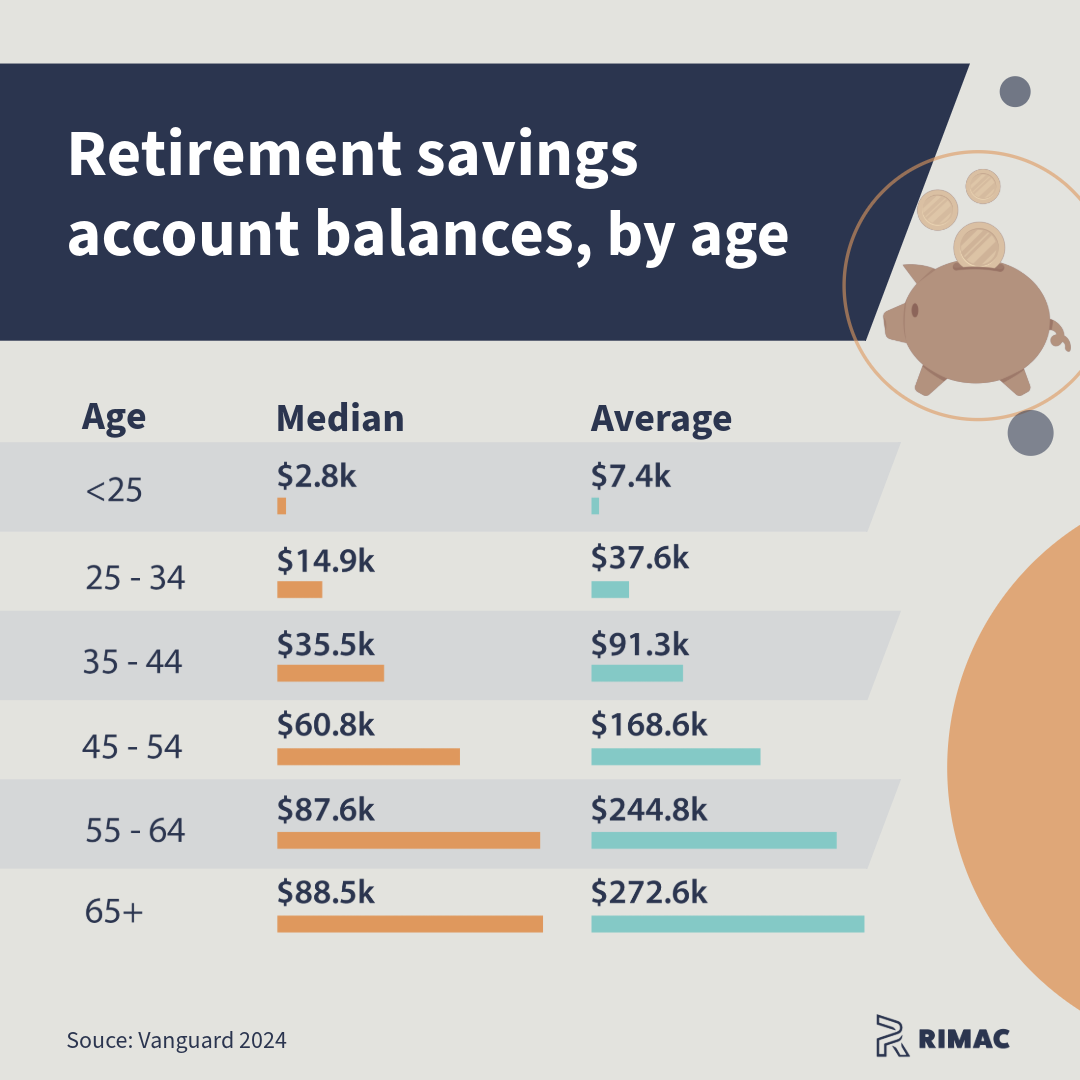

In addition, the report found that the average account balance for Vanguard participants was $134,128, while the median balance was $35,286. The average account balance has increased by 19% since 2022 as a result of positive market performance alongside ongoing contributions over the year. Here is a look at how much money Americans have saved for retirement, by age:

Source: Vanguard 2024

Besides age, many factors influence retirement savings, such as income and how long a person has worked for a company. Older employees who have been working longer tend to have higher account balances than employees who are at the beginning of their careers. It is advisable not to be fixated on savings balances but rather to focus on factors that investors can control such as expenses, investment choices and the savings rate (typically between 12 - 15% including employercontributions). This rate could be challenging for many, especially those who are starting out so sticking to at least to get the employer’s full match would be a first step.

Other Factors Helping Workers Increase Savings

Improved Asset Management: Employee investment decisions are a critical determinant of long-term retirement savings growth. Target-date funds have remained a dominant choice, offered by 96% of plans and used by 83% of participants, with 70% of participants fully invested in a single target-date fund. Only 1% of investors who invest exclusively in target-date fund traded in 2023.

Access to Investment Advice: Advice has become more accessible to plan participants. The plans offering managed account advice are at an all-time high, and 3 out of 4 participants now have access to financial advice. These professionally managed investment portfolios dramatically improve diversification compared to portfolios of participants who make their own choices.

Bottom Line

Retirement participants continue to benefit from the ever evolving 401k plans that have added strong features like automatic solutions, while plan sponsors continue to expand the breadth of offerings available within retirement plans. The rate at which workers are saving for retirement is at an all-time high, however when looking at the account balances for the median 401k of a person approaching retirement (65+) remains very low, and we could assume that most Americans are still very reliant on Social Security for a large portion of their retirement. What can actually be done here? The simple answer is, to have a more robust retirement, Americans are just going to have to save much more. The future does look promising given the data in this report and all we do is save more day by day.