IRS's 2025 Tax Bracket Changes: What You Need to Know

Key Takeaways

The Internal Revenue Service (IRS) announced new increases for the 2025 tax brackets.

Standard deductions have also been increased for 2025.

SALT deductions and Child Tax Credit remain the same for 2025.

Every year, the Internal Revenue Service (IRS) evaluates tax provisions and adjusts them if necessary. As a result, the IRS has recently announced inflation-adjusted changes to the 2025 tax brackets among other provisions for that year.

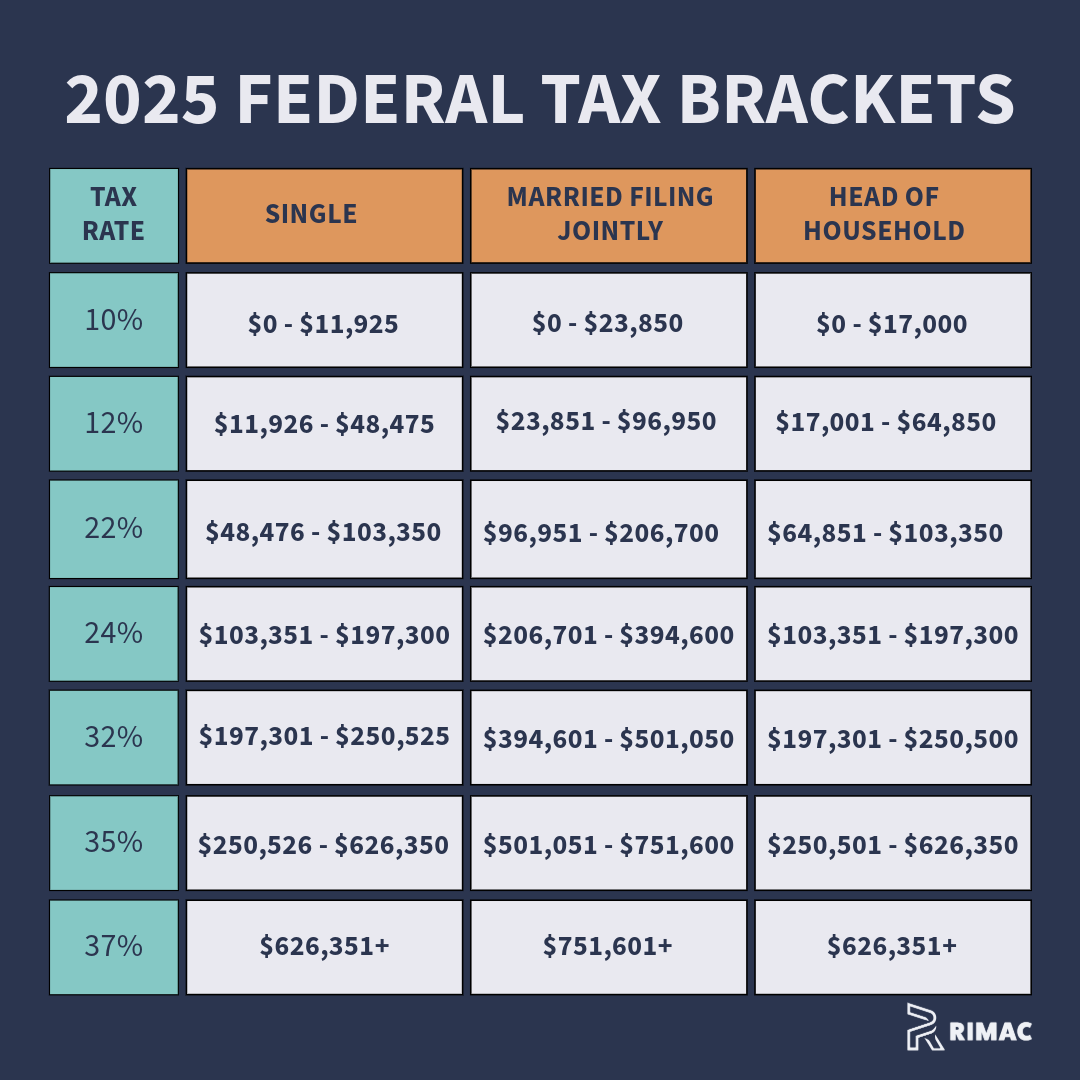

2025 Federal Tax Brackets

Source: Rimac Capital

What are tax brackets?

Federal tax brackets are income ranges that determine the percentage of federal income tax you owe, based on your earnings and filing status (e.g., single, married). The U.S. tax system is progressive, meaning income is taxed at increasing rates as it rises. Each portion of your income is taxed at the rate for the corresponding bracket, not the highest rate throughout.

For example, single filers that earn more than $11,925 which is the top threshold for the 10% bracket in 2025, could owe $1,192 in federal income tax, or 10% of their first $11,925 in earnings, and then 12% on any income above that amount, up to $48,475.

Tax Brackets Changes for 2025

For 2025, the tax brackets range from 10% to 37%. These rates are the same as 2024, but the difference is the taxable income range for each rate.

For single filers, if your income is over $197,300, or $394,600 as a joint filer, your 2025 marginal rate is 32%. In 2024, the income level for the 32% marginal tax rate was anything above $191,950 for single filers and $383,900.

Here is a summary of all tax bracket changes for 2025:

10% for incomes less than $$11,925 ($23,850 for married couples filing jointly). 2024 income range: less than $11,600 single/$23,200 married filing jointly.

12% for incomes over $11,925 ($23,850 for married couples filing jointly). 2024 income range: $11,600 single/$23,200 married filing jointly.

22% for incomes over $48,475 ($96,950 for married couples filing jointly). 2024 income range: $47,150 single/$94,300 married filing jointly

24% for incomes over $103,350 ($206,700 for married couples filing jointly). 2024 income range: over $100,525 single/$201,050 married filing jointly.

32% for incomes over $197,300 ($394,600 for married couples filing jointly). 2024 income range: over $191,950 single/$383,900 married filing jointly

35% for incomes over $250,525 ($501,050 for married couples filing jointly). 2024 income range: over $243,725 single/$487,450 married filing jointly

37% for incomes over $626,350 ($751,600 for married couples filing jointly. 2024 income rage: over $609,350 single/$731,200 married filing jointly.

New Standard Deduction Changes for 2025

The standard deduction is a fixed dollar amount that helps lower an individual’s taxable income. This amount varies depending on your filing status. You have two choices when you file your taxes:

Standard deduction: In this scenario, you deduct the standard deduction amount from your total income for the year. The outcome is your taxable income which is what your tax is based on.

Itemized deductions: Here the taxpayer can itemize deductible expenses such as mortgage interest, medical expenses, charitable donations and more. If these expenses add up to more than the standard deduction, the taxpayer could use this option.

Standard deduction amounts for 2025:

$15,000 for single filers and married individuals filing separately, a 2.67% increase from the current tax year’s $14,600 ($400 increase).

$30,000 for married couples filing jointly, compared to $29,200 this year 2024 ($800 increase).

$22,500 for head of households, increasing $600 from the tax year 2024.

To conclude our understanding of standard deduction, as an example, a single filer earning $100,000 of income for the year could apply the 2025 standard deduction to reduce his taxable income to $85,000. Similarly, a married couple filing jointly with a combined income of $300,000 could reduce their taxable income to $270,000.

Other Tax Provision Changes

Estate tax: This is the dollar figure for how much in assets can be sheltered from the estate tax. This federal estate-tax exclusion amount will increase to $13.99 million from $13.61 million in 2024.

Tax-free gifts: For 2025, individuals will be able to give others up to $19,000 on a tax-free basis, an increase from $18,000 this year.

Earned Income Tax Credit (EITC): The EITC helps low- to moderate-income workers and families get a tax break. For 2025, single people that can qualify can claim $649 on their tax returns, compared to $632 in 2024. Similarly, the maximum EITC amount that a family can claim in 2025 will be $8,046, up from $7,830 in 2024, however, it is important to note that this only covers qualifying households with three or more children.

No Changes in 2025

Additionally, there are some tax provisions that aren’t adjusted on an annual basis and will remain the same in 2025. Some of these provisions are:

Child Tax Credit of $2,000 with a refundable amount of $1,700 will remain the same.

The state and local tax (SALT) deduction cap of $10,000 will not change.

The lifetime learning credit (LLC) which is for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution. It is worth up to $2,000 per tax return and will remain the same.