401(k) Contribution Limits and New Catch-Ups for 2025

Key Takeaways

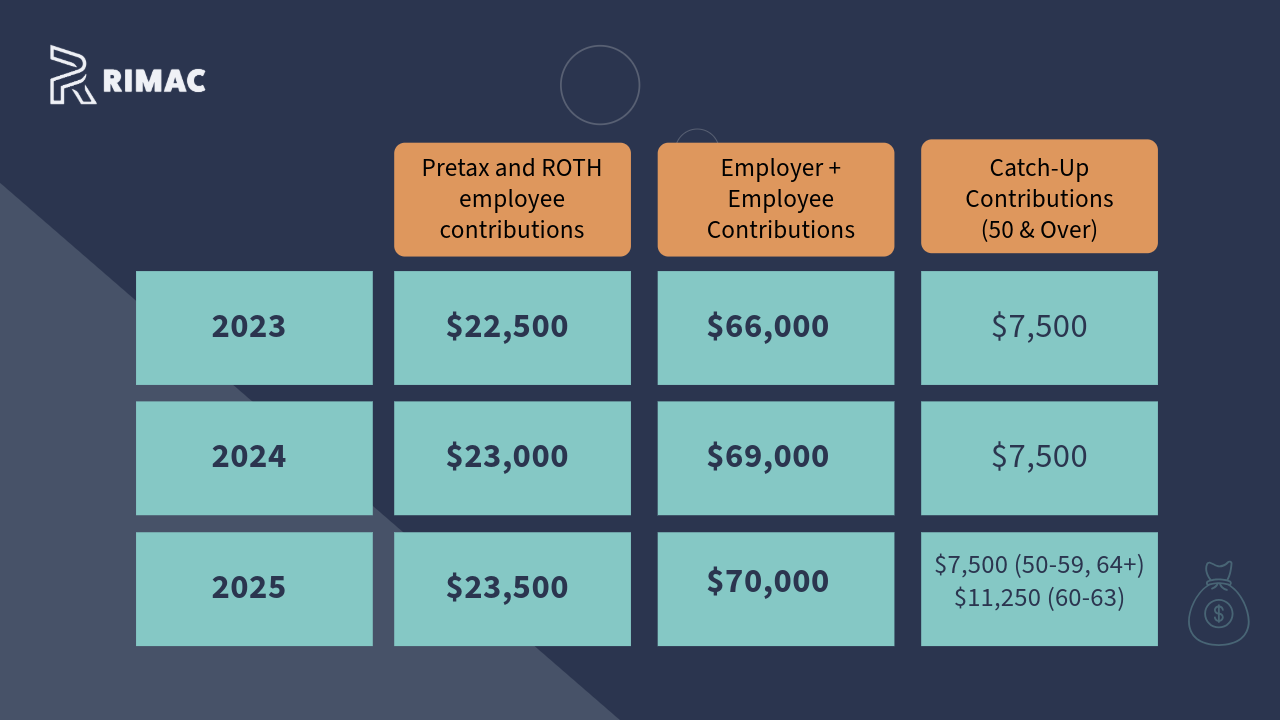

For 2025, the most you can contribute to a Traditional pretax 401k and ROTH 401k is $23,500, increasing by $500 from 2024.

Those aged 50 and older can contribute an additional $7,500.

Starting 2025, those 60 to 63 are able to contribute an additional $11,250 in a new ‘higher’ catch-up contribution tier.

The IRS announced this month that the amount individuals can contribute to their 401k plans in 2025 has increased to $23,500, up from $23,000 in 2024. IRA contribution limit will stay the same in 2025 at $7,000.

401(k) Contribution Limits

Source: Rimac Capital

The annual contribution limit for employees who participate in 401k, 403b, 457 plans have been increased to $23,500, and to $70,000 for the combined employee and employer contributions.

If the employee is aged 50 to 59 or 64, they are eligible to contribute an additional $7,500 in catch-up contributions, increasing their employee contribution to $31,000 (from $23,500). Starting 2025, there is also a new “higher” catch-up for employees aged 60, 61, 62 and 63 who participate in these plans. This higher catch-up contribution is $11,250, when compared to the standard catch-up contribution of $7,500. In summary, this means that employees aged 50 to 59 or 64 and older are eligible to contribute up to $31,000 in 2025 while those aged 60 to 63 will be eligible to contribute up to $34,750 in 2025. As a reminder, total contributions cannot exceed your annual compensation at the company that holds your plans.

Contribution Limits:

Pretax and ROTH employee contributions: $23,500

Employee and Employer contributions: $70,000

Catch-up Contribution (if aged 50-59 or 64+): $7,500

Catch-up Contribution (if aged 60-63) $11,250

Source: Rimac Capital

Advantages of Contributing to a 401k

One key advantage of 401k plans, offered by many employers, is the employer match. This means the company will match employee contributions up to a certain percentage of the employee’s income - typically between 3% to 5%. To maximize this benefit, employees should contribute at least up to the matching limit to take advantage of this ‘free money’ even if it means prioritizing the 401k over other accounts like IRAs.

Another major benefit of most 401ks is their tax-deferral feature which allows employees to avoid paying income tax on contributions for the year, effectively lowering their total taxable income. Some employers also offer a ROTH 401k option, though many employees are not aware of this.

These plans provide a clear annual savings target for retirement. While employees are generally encouraged to save beyond the plan limits, these plans establish a minimum contribution goal to aim for each year.

401k Contribution Limits for Multiple Plans Across Employers

If you participate in 401k plans from multiple employers, your total employee contribution is still capped at the annual limit. For example, if you have two 401k plans, you can divide your 2025 maximum contribution of $23,500 between them

Note: These limits don’t impact what you can contribute to an IRA. You’re allowed to contribute the full legal maximum to both a 401k and an IRA each year.

Consequences of Overcontributing to your 401k

Exceeding your 401k contribution limit can result in significant penalties, including a 10% fine and unpaid income taxes on the excess contributions when they’re withdrawn. These excess contributions will appear on Form 1099-R for tax reporting purposes.

Fortunately, most 401k plans are designed to prevent overcontributions. However, if you change jobs midyear or participate in multiple plans, you could inadvertently contribute too much. If this occurs, you’ll need to request a refund of the excess by April 15, including any earnings it generated while in your 401k. Excess contributions and earnings are treated as taxable income and should be reported on Form 1099-R.

Conclusion

A 401k plan is one of the most powerful retirement savings tools available, yet many employees do not maximize it the way they are supposed to do. When compared to other retirement plans such an IRA, 401k plans allow for much higher annual contribution limits offering greater capacity for tax-deferred growth over time. This tax-deferred feature allows for investments to grow without being taxed until the employees withdraw funds, typically in retirement. Finally, the IRS tends to raise contributions limits each year to keep pace with inflation allowing employees to increase their savings rate gradually and work toward a more secure retirement as their income grows.

Connect with Us Today

Schedule a free 30-minute consultation call. We’ll learn more about your priorities and ensure we can answer all of your questions.