What Notorious Celebrity Cases Can Tell Us About Asset Protection

You may have heard last month that before he was arrested, music mogul Sean “Diddy” Combs paid off the $18.8 million mortgage on his Florida home valued at $48.5 million. Even for the very wealthy, throwing almost $19 million at a problem better have a well thought out rationale and reasoning. Mr. Combs surely consulted his lawyers, financial advisors and accountants to coordinate this move.

But why would he do this before being arrested? Another celebrity example can also provide some clues. O.J. Simpson had an outstanding judgment against him of $33 million dollars from his civil wrongful death case in 1997. That judgment wasn’t paid in any meaningful way over the years and by the time of his death in 2024, it had ballooned to around $100 million. Yet Simpson lived a seemingly luxurious lifestyle in Florida. One of the reasons for this is what is sometimes referred to as the Florida Homestead Act. Simpson acquired his principal residence in the state of Florida. Article X, Section 4 of the Florida Constitution protects a Florida resident’s homestead from creditors.

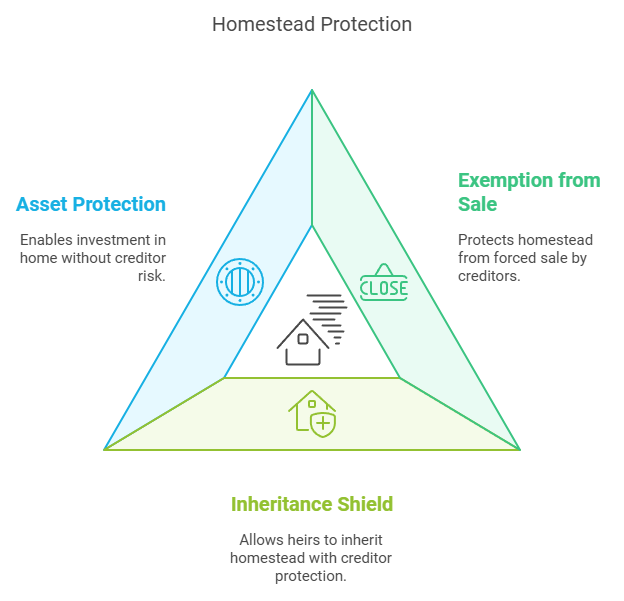

The Florida Homestead Act provides homeowners with valuable protections, particularly from creditors, by designating their primary residence as a protected homestead. Here’s a breakdown of how it works and the protections it offers:

Exemption from Forced Sale: Under the Florida Constitution, a homestead property is protected from forced sale by most creditors. This means that, if you have unsecured debts or financial judgments against you, creditors cannot force the sale of your homestead to satisfy those debts. This applies to personal residences, and it shields both the property and a certain amount of land (up to half an acre within an urban area or up to 160 acres in rural areas).

Exceptions to Homestead Protection: While the Homestead Act is broad, there are exceptions. You are not shielded from foreclosure if the debt is tied to the home itself, like a mortgage, property taxes, or contractor liens. Additionally, it doesn’t protect against federal debts like IRS tax liens or support obligations like child support or spousal support.

Inheritance and Transfer Limitations: The homestead protection passes on to your heirs, which means they can inherit your home with the same shield from creditors. However, transferring or selling a homestead property to shield it from creditors can be complex and may have legal limitations or implications, particularly regarding how it affects the homestead’s protected status

Asset Protection: The Homestead Act can be a valuable asset protection tool, allowing homeowners to invest in their home without the risk of losing it to creditors. This is particularly beneficial in a state like Florida, which doesn’t have state income tax; some high-net-worth individuals use it as a legal way to protect their wealth.

Florida homestead protection is one of the strongest in the U.S. yet it’s not the only one. Several other states have homestead laws similar to Florida’s, offering protection from creditors for a primary residence. However, the level and specifics of protection vary by state. Here are some notable states with strong homestead protections:

Texas - Like Florida, Texas has robust homestead protections against creditors, with no dollar limit for the property value, covering up to 10 acres in an urban area and up to 100 acres in rural areas for individuals (200 acres for families).

South Dakota - Offers unlimited protection on homestead property against unsecured creditors, similar to Florida. However, it is limited to 1 acre in city limits or 160 acres elsewhere.

Kansas - Provides unlimited homestead protection on a primary residence, with acreage limited to 1 acre within city limits and 160 acres in rural areas.

Iowa - Offers a homestead exemption up to 40 acres in rural areas or up to ½ acre in cities.

Nevada - Provides homestead protection up to a certain dollar amount ($605,000 as of 2023), which protects the equity in the primary residence from creditors.

The level of homestead protection can vary significantly, with some states providing unlimited protection like Florida and Texas, while others have specific equity limits or acreage restrictions.

Retirement Assets Are Also Protected

Another set of assets that is protected against creditors in many cases are retirement assets. Mr. Combs, like many entrepreneurs and workers today, likely doesn’t have a 401k or a pension. But in the case of Simpson, besides his home, the other reason Simpson was able to live a luxurious lifestyle has to do with federal protection for retirement assets. Simpson benefited from pensions from both the Screen Actors Guild and the National Football League (NFL). Pensions and retirement plan assets are often the best protected assets people own. Virtually all ERISA-qualified pension plans are federally protected from both creditors and bankruptcy. This includes most defined benefit pension plans, 401(k), profit-sharing or money purchase plans.

Simpson’s pensions, combined with his Florida homestead, allowed him to live very comfortably despite the civil judgment. This is a significant consideration for us all regarding our own asset protection plans.

It should be noted that traditional IRAs, Roth IRAs, SEP, KEOGH plans and 403(B) plans are not provided with federal protection. Those accounts may be protected at different levels based upon state law.

Trusts, Prenups & Wills

One of the more popular questions that we get as advisors is how do I protect my assets? There isn’t always a simple answer since it is typically highly dependent on the personal situation of the person asking. It also depends on whether they are looking to protect their assets during their lifetime, entering marriage or after death, each one comes with a unique solution, as well as tax considerations that need to be weighed before making a decision. Some of the most popular examples we see include:

Protecting Assets Prior to Marriage - This is typically handled through a prenuptial agreement. It’s important to keep in mind however that this only covers assets that were obtained prior to marriage. Eleven the growth in those assets is not safe, if you had stocks that were invested prior to marriage and doubled in value while married, then a quarter (half the growth achieved during marriage) could be divided in a divorce.

Protecting Assets During Divorce - It hurts to say this, but this is nearly impossible. Divorce settlements and litigation is riddled with uncertainties and it never pays to hide assets during a divorce and incur the wrath of the judge.

Protecting Assets During Marriage - Postnuptial agreements are also an option if a prenup has not been signed although depending on your relationship, it could get contentious so it needs to be approached with caution. As with a prenup, it will be limited in terms of what you can financially separate in many states once you are married. Another option is also an irrevocable trust, again here once married both spouses would need to consent to the terms.

Protecting Assets from Spendthrift Children or Ex-Spouses - For those that are divorced, one of the best motivating factors to get working on a will is that even if they leave their assets to their children post divorce, if those children happen to be under 18, then their estate will in most cases transfer to their ex-spouse. Sometimes that isn’t the issue but people may be worried that their whole estate passing to a 20 year old wouldn’t be used responsibly. In these cases what’s called a testamentary trust can be created, which is a trust created by a will only when the testator (the person whose will it is) passes on. This trust can be customized, for example to pay out a certain stipend per year or to not pay at all until adult children have reached a certain age such as 35.

Depending on the state you reside in, your tax situation, your legal status and your marital status, one asset protection plan will not always look like another. Add to that the terms of a divorce, judgment or settlement, the terms of which can carry on for many years after these issues are finalized and you may find yourself with the need of professional advice. As more news brings the financial details of notorious celebrity cases to light, it will be interesting to see some of the innovative structures that the rest of us may be able to utilize.

References:

1. Alper Law

Alper Law. “Florida Homestead Law.” Alper Law, accessed October 31, 2024. https://www.alperlaw.com/florida-asset-protection/florida-homestead-law/.

2. Speiser Law Firm

Speiser, Jonathan. “Understanding the Benefits of Florida’s Homestead Law.” The Speiser Law Firm, September 1, 2022. https://www.speiserlaw.com/2022/09/floridas-homestead-law/.

3. Asset Protection Planners

Asset Protection Planners. “Homestead Exemptions by State.” Asset Protection Planners, accessed October 31, 2024. https://www.assetprotectionplanners.com/planning/homestead-exemptions-by-state/.

4. The Florida Bar Journal

The Florida Bar Journal. “Florida Exemptions and How They May Be Lost.” The Florida Bar, accessed October 31, 2024. https://www.floridabar.org/the-florida-bar-journal/florida-exemptions-and-how-the-same-may-be-lost/.

5. Goralka Law Firm

How did O.J. Simpson avoid paying the Brown and Goldman families? Goralka Law Firm. Retrieved 11/4/24,from