How to Manage Multiple 401k, 403(b), 457 and IRA Plans

As remote work has become more common since the pandemic, so has the need to manage multiple jobs for those ambitious few who hold multiple jobs. This isn’t just an issue for those that are trying to work 2 jobs in secret which the mainstream press has focussed on. Many different types of skilled employees have the ability to both work for a traditional W2 employer as well as act as a 1099 contractor with other employers. Workers who are in high demand like this and highly compensated (healthcare is one field that comes to mind) may have the option to establish both a SEP IRA for their 1099 work as well as reap the benefits of more traditional retirement plans such as a 401(k) or 403(b).

This post will focus on the difference between those types of plans most commonly seen among private, government and non-profit employers and how Rimac can assist skilled professionals in navigating and maximizing these plans, supercharging their own retirement in the process.

Types of Plans

401(k)

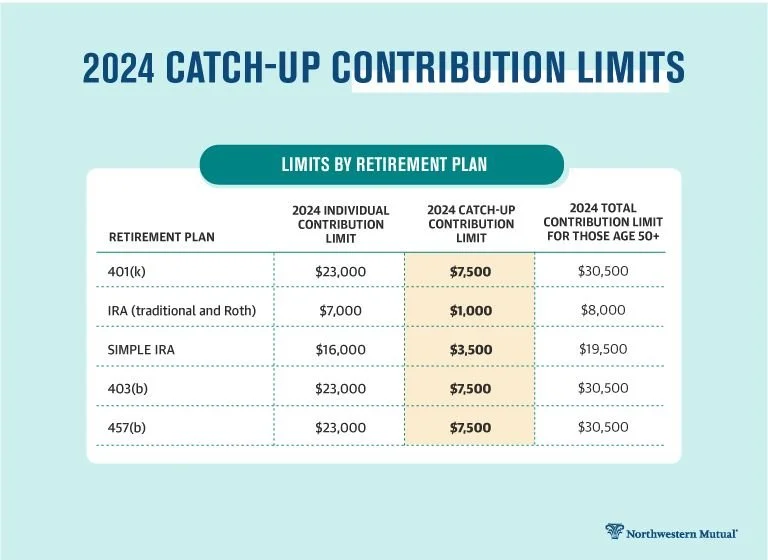

This is the most common plan for private corporations, this is an employer sponsored plan. The limit for contributions for 2024 is $23,000 per employee not counting employer contributions. If the employer contributes then the total employer and employee contributions cannot exceed $69,000 for 2024. If you are over 50, there is an allowed catch up contribution of $7,500 which can be made. This $23,000 total is across different employers. If you have multiple 401(k) plans, then the total that you contribute combined among all of them cannot exceed $23,000 in the tax year. This is called the one employee contribution total.

Example: So for someone who is 45 years old, they can allocate a maximum out of their income of $1,916.67 per month for 12 months to total $23,000. Employers often provide matching of between 3% and 5% up to some maximum figure, in this example let’s choose $4,000. So this 45 year old could contribute $23,000 for the year and the employer would match $4,000 for a total of $27,000.

However, some employers also offer a profit sharing retirement contribution mechanism for good times. Let’s say an employer had a banner year and wanted to give back to employees through retirement account profit sharing. The employer in this case could contribute an additional $42,000 into the retirement account of our 45 year old for a total retirement contribution of $69,000 That is, $23,000 from our employee, $4,000 in matching and $42,000 in profit sharing.

If that same person was over 50, they could contribute $30,500 out of pocket, see the $4000 matching and along with the company’s $42,000 contribution could reach $76,500 for the year.

403(b)

Very similar to a 401(k) plan is a 403(b) plan. It also allows employees to save for retirement while receiving tax benefits. The difference is that 403(b) plans are offered by public schools, churches and certain tax exempt organizations such as non-profit hospitals i.e. 501(c) organizations. The same total contribution limit applies to the above however, i.e. that the $23,000 limit applies to your own contributions across employers. So if you have a 403(b) and a 401(k) again, that $23,000 employee contribution limit is combined across accounts.

457(b)

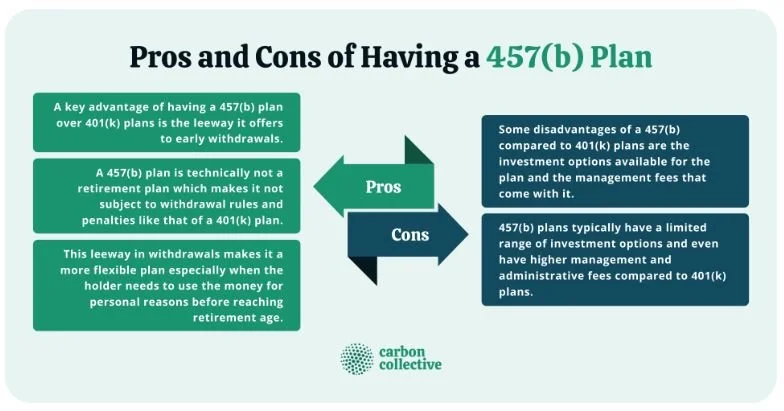

This is a plan for deferred compensation for state and local governments and tax exempt organizations (those 501(c) organizations described above). The 457(b) plan is the most common type of plan seen under this code. The key point to understand about 457(b) plans is that they are deferred compensation from your employer to you. That means that it is money the employer owes you but that the employer has not yet paid you. There are both tax-deferred (traditional) and tax-free (Roth) versions. It is also important to note whether your 457 is governmental or non-governmental, in the former case, the 457(b) shields your assets from your creditors. It isn't your money (yet), so your creditors can't take it. In the case of a non-governmental account, it may be available to your employer's creditors. The annual contribution limit for a 457(b) plan mirrors that of a 401(k) or 403(b)—$23,000 in 2024. This amount however is independent of what has been contributed to a 401(k) or 403(b) so if employees can afford it, we almost always advise that clients try to max out their 457(b).

There is no early withdrawal penalty from a 457(b), at least if you are allowed to make a withdrawal. While taxes may be due, there is no extra 10% tax for withdrawing prior to age 59 1/2. However, plans generally require you to either separate from the employer first or, at least, have a hardship before you can make a withdrawal.

Like 403(b)s, 401(k)s, Roth 401(k)s, Roth 403(b)s, and traditional IRAs, 457 plans have required minimum distributions (RMDs). If you have not already depleted the account, beginning at age 73, you will be required to take a certain amount of money out of your account each year or pay a huge tax (50% of the amount you should have withdrawn). You don't have to spend the money, but you do have to remove it from the retirement account and reinvest it elsewhere.

After you leave your employer, what you can do with the 457 depends on whether it’s a governmental plan or not. If it’s a governmental plan it can be rolled into an IRA or taken out and taxes paid on it. If it’s not a governmental plan then you are only allowed to roll it into another 457(b) plan, leave it or pull out the funds according to the plan rules and pay the taxes due (no taxes if it’s a Roth 457(b).

Getting More Complicated - Rules Per Unrelated Employer

The IRS also only allows you and your employer (which might also be you) to put a total of $69,000 for 2024 ($76,500 if 50+) per year into a 401(k). This includes the employee contribution, any match from the employer, and any employer contributions. This is the same limit for a SEP-IRA (if <50) which is technically all employer contributions. However, this limit applies to each unrelated employer separately.

“Unrelated employers” means that the businesses doing the employing are not a “controlled group.” There are two types of controlled groups:

“Parent-Subsidiary” Group

This is when a parent business (corporation, sole proprietor, LLC, partnership, etc.) owns 80%+ of another business.

“Brother-Sister” Group

This is where 5 or fewer individuals, estates, or trusts own a controlling interest (again, 80%+) of two different businesses.

So if the two businesses you are involved in aren't a controlled group, and they each have a 401(k), (or a 401(k) and a SEP-IRA) you get two $69,000 limits. In layman’s terms, as long as you own 20% or less of the other company offering you a 401(k) or 403(b) then you have a second limit of $69,000 in total employer and employee limits

Example: A single doctor works for 2 hospitals as well as is a self employed 1099 employee. In hospital 1, the doctor earns $150k is offered a 401(k) and a 457(b) with employee match up to $5k on the 401(k). In hospital 2 the doctor earns $100k, has a 403(b) with a match of up to $7k. Our doctor then has a personal corporation where they earn 1099 income which totaled $400k in 2024. This doctor also has an IRA which he contributes to every year up to the limit, which in 2024 is $7k. This doctor could maximize their contributions to all accounts as follows:

Hospital 1 401(k): At least $5K plus the $5K match = $10K

Hospital 1 457: $23K

Hospital 2 403(b): At least $7K plus the $7K match = $14K

Plus $11K into either 403(b) or 401(k) plans depending on which offers the best investment options

Plus another $69K into the SEP IRA for their 1099 employment

Plus $7K for their IRA

Total: $134,000

Special Notes

These Rules Have Nothing to Do with 457s, IRAs, or HSAs

457(b)s, Backdoor Roth IRAs, and HSAs all have their own separate limits that have nothing to do with the limits for 401(k)s, 403(b)s and SEP-IRAs. Putting more into an HSA doesn't mean you can't still max out your 401(k).

Catch-Up Contributions Also Allow You to Surpass the $69K Limit

Many accounts have catch-up contributions if you're old enough (usually 50 or older, but 55 or older for HSAs). Roth IRAs have a $1,000 catch-up, HSAs have a $1,000 catch-up, and 401(k)/403(b)s have a $7,500 catch up. That $7,500 catch-up is in addition to the $69K limit, so if you're over 50, you're self-employed with lots of income, and you make your full $30,500 employee contribution to your individual 401(k), the $69K limit becomes a $76,500 limit. Note that 457(b) catch-ups and 403(b) catch-ups work slightly differently.

403(b)s Are Not 401(k)s

Some employees have access to a 403(b) by working for a public entity. There is a unique rule for 403(b)s, however, which will prevent many who use a 403(b) at their main job from maxing out an individual 401(k) on the side, at least if they own 50% or more of the company for which they have an individual 401(k). Essentially, your 403(b) at work, unlike a 401(k), is considered to be controlled by you. So you are limited to the same 415c limit of $69K (see Chapter 3 at the link). So if you put $23K into your 403(b) at work, you are only allowed to put $69K-$23K=$46K into an individual 401(k). Note that the individual 401(k) is distinct from the SEP-IRA which is different.

If you’ve made it this far, you may still be a little overwhelmed at all the options. The retirement system was created as a hodgepodge of different rules and laws so isn’t necessarily designed to be easy to understand and intuitive. If you are lucky enough to be offered multiple retirement options such as were mentioned here, please reach out to one of our advisors to assist in maximizing your retirement and increasing your investment options which can be offered through rolling over into an IRA or a SEP-IRA that we can assist you in setting up.