Where Are The Customer’s Yachts? - A Guide to the RIMAC Investment Policy

A Guide to the RIMAC Investment Policy

The title of our guide refers to a timeless book on investment written by Fred Schwed and published in 1940. The title refers to a story about a visitor to New York who admired the yachts of the bankers and brokers. Naively, he asked where all the customers' yachts were? Of course, none of the customers could afford yachts, even though they dutifully followed the advice of their bankers and brokers.The fact that this book was written over 80 years ago and that much of its cynical views still hold true, is a testament to how deeply connected the way we deal with money is more often than not driven by emotion and irrationality.

Abel and I started Rimac after years of work in the financial and tech industries where we saw the ins and outs of wealth management, private credit and markets. We saw a demand for advice that was transparent, more accessible and sophisticated compared to the mostly salespeople who are the majority pushing wealth advice. Every advisor would like to posit how different they are to stand out from the crowd. Yet we believe our radically practical and transparent approach truly makes Rimac a one of a kind firm for your wealth advice. To show this, we would like to share our core investing principles. After taking these in, we hope you will understand better where we stand and what gets us up out of bed every morning.

We Believe in Maximizing Long Term Well Being for Our Clients

You may be thinking, what does this mean really? So let us explain. Rimac is a firm that is not going to push a hot stock or beat the market in any given year. There has been enough academic research to show that over the long term this is a fool’s errand for most people. Our advisors make sure that you are saving properly and in the most tax efficient manner. We make sure that you achieve low cost diversification across markets to reduce the volatility of your portfolio for a given target return. Apart from investing, this can also mean advising our clients on what NOT to do as much as what to do.

For example, using a half of your savings near retirement to open a risky business like a restaurant in a major metropolitan area (where there is a lot of competition) may not be something we would advise a client to undertake. Sometimes sitting a hot investment out is the best course of action and Rimac will be your partner and coach in such times. It can also mean that some portfolios may look a bit boring, and we don’t shy away from that, if boring gets our clients where they need to be, we will take ‘boring’ every time. If we put you into boring funds for 20 years that grew to meet your goals and saved you $500,000 in taxes over your lifetime would you feel we’ve earned our fees? Your well being doesn’t just include your money and retirement. It can also mean taking care of loved ones or leaving a legacy. Our access to Trust and Estates attorneys and charitable giving allow us to add value for clients with all types of objectives.

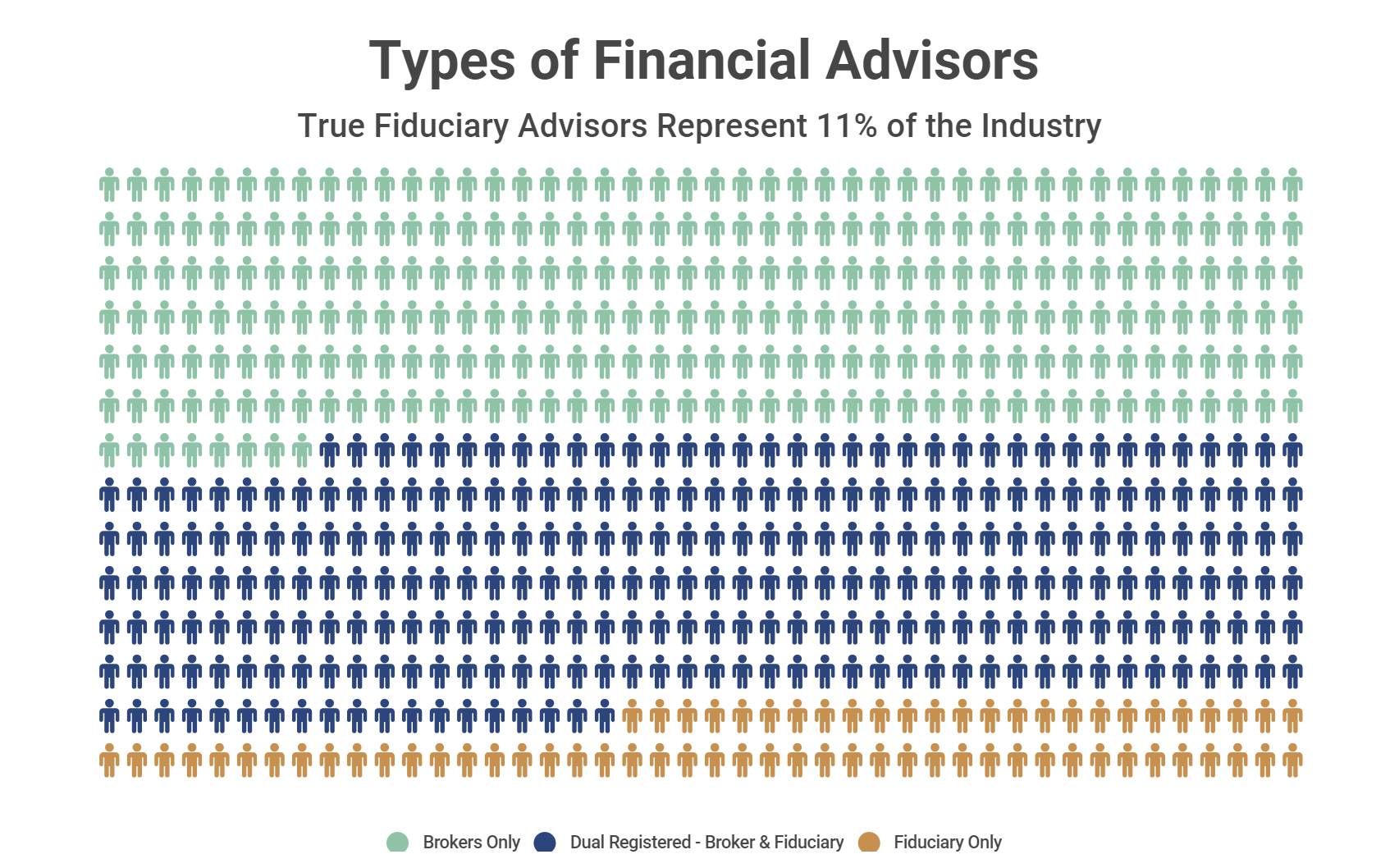

We believe that Trust is built through Transparency

Rimac is a fiduciary firm required to put its client’s interests first. As of June 2023, of the 385,058 Registered Investment Advisors (RIA) in the U.S., 307,590 of them are Dual-Registered Advisors. This means that only 69,482 RIAs are true fiduciary investment advisors without this huge conflict of interest. This represents only 11.2% of the 689,925 financial advisors in the U.S. (source). When an advisor is associated with a broker dealer firm, they are almost always paid a commission to push the products that their brokerage gets paid a hidden fee for. Asset management firms pay these “distribution fees” to brokers to push the funds onto their clients. They don’t even have to be in the client’s best interest, they just have to be deemed “suitable” for a particular client. We believe this model is ethically indefensible and by propagating it, the wealth management industry has engendered a general mistrust and skepticism of financial advisors that hurts the industry in the long run. Rimac offers fees based on the assets we manage or a flat fee for financial advice if clients prefer. This allows clients to choose which payment method they feel most comfortable with and takes the conflict of interest out of our advice. Our prices for both assets we manage and flat fee advice are designed to be competitive with low cost advisors such as Vanguard but with what we believe is better quality service. Allowing Rimac to manage your assets for you allows us to also explore alternative investments that may not be available to lower cost providers such as private equity, private real estate and derivatives.

We Believe in Accountability Through Benchmarking

Benchmarking, or establishing a standard investment that your portfolio is to be measured against, is the bane of most advisors’ existence and they will avoid it if they can. Not at Rimac. We examine your holistic investment portfolio across your retirement, brokerage and private assets against an agreed upon benchmark and evaluate the performance of our advice on an annual basis. If our clients outperform, we can point to why and what extra risk or special investment they took to get there. If they underperform, we can also pinpoint the source of why and discuss if adjustments need to be made and risk reduced. Sometimes underperformance may be expected due to client driven constraints and that’s ok, as long as it is understood and communicated clearly.

We Are Constantly on The Hunt for New Alternatives

We believe an investment advisor should be passionate about any avenues to getting their clients towards their goals. Rimac is willing to consider and guide retirement scenarios that may be outside of the traditional box such as retiring overseas, early retirement and utilizing foreign trusts. We are constantly examining the latest investment research to explore new alternatives such as factor funds, alternatives indices, derivatives, private equity, venture capital, crowdfunding, commodities and futures to achieve target returns with minimum volatility.